My oldest graduated from college last spring, and my youngest has two years remaining. We managed to cobble together about half of the amount needed for tuition and room/board, investing irregularly in our state’s 529 Plan. We never really had a goal in mind, but became more focused as they entered high school. If you’re just beginning to save for your children, here are some things to keep in mind.

Investigate your local colleges

Since I attended college, the flagship university in our state has become much more challenging for students to get into. Smarter local kids are going there, much of it due to the fact that the state offers a scholarship that fully pays for tuition to state schools. The student must keep a certain grade point average in high school to receive the scholarship, and must maintain their grades throughout college.

These programs don’t only exist here. Look closely at your state’s offerings. Are the schools in your state competitive? Is there any incentive provided for your child to stay in state? Find out as much as you can about your in-state schools before moving on to a national review.

Pick a school type

I went to a public university. My wife went to a private college. Neither of us was really set in our ways, demanding that our two kids followed in our footsteps. However, you may think differently. If you must have your progeny matriculating at the private college you attended, then your research is over.

Consider several top private schools and public schools, comparing the differences in cost along with the value offered. Some publications can help you determine the return on investment. For instance, you might want to consider several majors to compare between schools, like computer science or marketing. Then you could see what the average salary is for graduating students versus the cost for four years of college. Maybe the higher cost of private is worth it; maybe public is a true bargain where the graduate is still offered a competitive salary.

Invest while they are young

The best thing I did for my kids was invest while they were toddlers. Not only did I receive a state tax credit, the money doubled several times before they reached 18 years old. However, I never had a set investment program. At one point I put a few thousand in, then later I invested more. While it worked for my kids, skipping my haphazard approach and regularly investing for your children could achieve better results.

One third? One half?

Saving for college on top of retirement and life’s daily expenses can be challenging, especially when you realize that four years (or more) of college will set you back tens or hundreds of thousands of dollars. How do you wrap your mind around the numbers?

Now that you’ve got an idea of the type of school you want your child to attend, you should also have a rough idea of the cost per year for tuition, room and board, fees, and parking. (If you child will be attending school across the country, don’t forget travel costs!) Most experts don’t suggest you attempt to save the total cost, especially if you are already stretched thin with your current expenditures. Instead, they suggest you save one-third to one-half of the expected cost and rely on student loans or jobs for the rest. So, if you find that your child’s education would be $150,000 for four years, your goal may be to save somewhere between $50,000 and $75,000. Research online calculators to see how much you would need to save, remembering that college expenses often outpace inflation (so you may have to nudge your contribution higher each year).

Where to invest

I’m a big believer in state 529 plans. You often receive a state tax break when you invest and a federal tax break when you withdraw money for college expenses. Research the ins and outs of your state’s plan. You can invest in a 529 from any state, but if you don’t use your state’s plan you may lose the tax break.

Some people have worried about saving too much in a 529 plan, where any excess not used for education would incur a penalty and taxes upon withdrawal. However, recent legislation allows you to invest up to $35,000 of your 529 balance into a Roth IRA. This provides a way to access some of your money penalty-free if you end up with too much in the account.

Roth IRAs. Some people use their Roth IRAs to pay for college too. Here you won’t receive the same tax treatment on withdrawals as a 529, but you also won’t have to pay the normal Roth penalty for withdrawing your earnings because you’re using them for educational expenses. And you won’t have to worry if there’s money left over in the account or what happens if your child doesn’t need college funding. Know that the contribution limit for a Roth is much lower than for a 529 plan, so it may be more difficult to build up large quantities of money in the 18 years you have available. Also, you won’t have any state tax break for your contributions to the IRA.

The combo, please. If you really want to get granular, I’ve heard of people investing 75% or more of expected college expenses in a 529, then building up a Roth on the side just in case they need the money. Yes, this is for people who can readily save for their children’s education. Still, if you have a Roth from a rollover or from having built one up over time, you can balance your contributions to a 529 if you think that’s the best path.

Remain flexible

When your child is a newborn, you may imagine they could be president or run their own company. When the kid you knew was going to play football ends up on a soccer field, or one who was going to be in the band instead dances, you realize (again) that they have minds of their own. College is the same, both the decision to attend and where they might want to go. Your best-laid dreams of having them at Alma-mater U might go up in smoke.

Be transparent

College funding is not something to keep secret from your children. Whatever you’ve saved or haven’t saved, be honest with your children when they begin high school. Let them know where you are financially and how that will translate to paying for college. For instance, you might be able to pay all expenses for an in-state school, maybe half for an out-of-state school, and perhaps a third for a private college. Don’t save this information until they have their heart set on the college in a small New England town that costs $80k per year.

In the end, any amount you save is better than saving nothing. Maybe you can’t help with tuition or room and board, but you can help with books and gas for the car. Just because you can’t save up 100% of the highest-cost college doesn’t mean you should do nothing. Save what you can, keep your kids in the loop, and help them enjoy the transition to college.

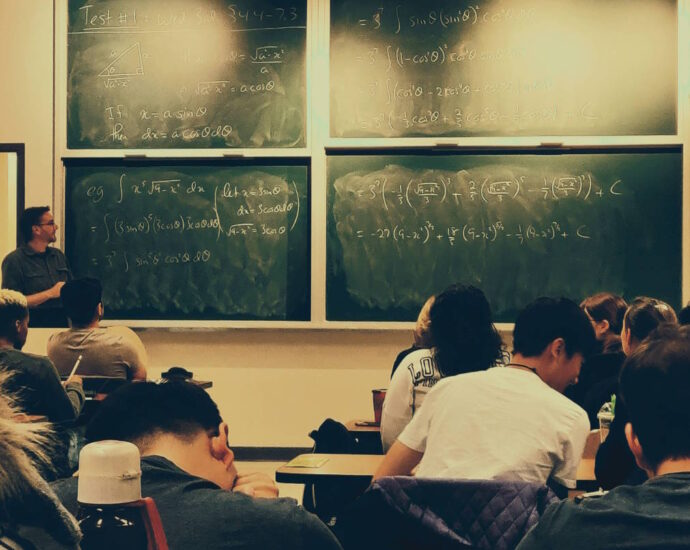

Photo by Shubham Sharan