With the advent of the FDIC in the 1930s, it would seem a run on a bank would be a thing of the past. Interestingly they happen more often than people realize. In fact, according to Bankrate.com most years see a few bank failures, and the longest time between banks failing is less than three years. Yet here we are again, wondering how one of the largest banks in the country can go under so quickly.

Banks invest your money

First, understand that banks don’t just act as a storage facility for your money. They use your money to make money, then pay you a certain percentage (if you have a savings account) or perhaps offer you free services with other accounts. Quite often they invest in bonds, which are considered relatively safe and provide a level of profit. If you’ve ever seen It’s a Wonderful Life, you will remember George Bailey explaining that the money isn’t there, it’s invested in the mortgages of other houses in town. Banks may also make money by lending it to customers for personal or business loans.

What causes a bank to fail

Failure to meet their obligations. Banks fail when they can no longer meet their financial obligations. According to Investopedia, “the most common cause of bank failure occurs when the value of the bank’s assets falls to below the market value of the bank’s liabilities, which are the bank’s obligations to creditors and depositors.”

Forced to raise money in a panic. If the bank cannot meet their obligations, they must raise money either by selling some of their investments or by borrowing money from other lending institutions. With recent increases in interest rates the value of long-term bonds fell, meaning that if a bank owned those and was forced to sell they may be selling at a loss.

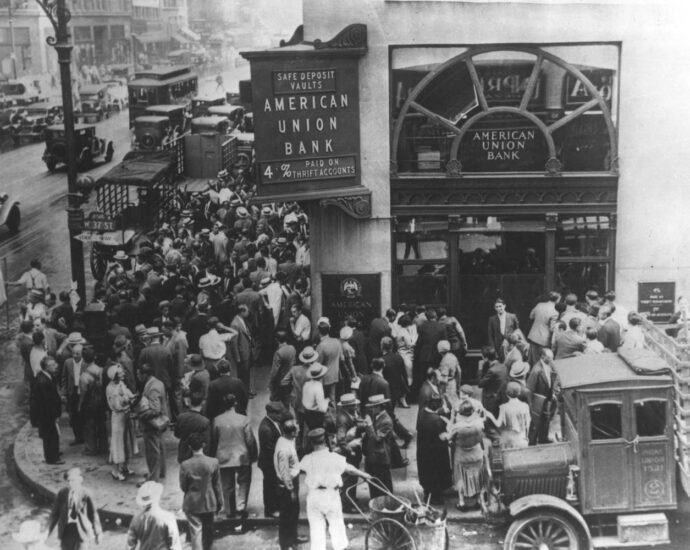

Customers rush to withdraw money. I’m sure you’ve seen the photos from the ‘30s of people standing in front of a closed bank, hoping to withdraw their life savings. Whether it’s in person or online, people often demand their deposits if there’s any inkling something is wrong with their bank. With the Silicon Valley Bank (SVB) fiasco, venture capital firms advised tech companies to withdraw their funds immediately. As more did, deposits dwindled until finally SVB could not pay out what was owed.

FDIC/FCUA

Banks are insured by the Federal Deposit Insurance Corporation (FDIC); credit unions have similar insurance provided by the NCUA (National Credit Union Association). Both provide depositors with $250,000 in insurance. That means that if you are single with a savings account at an insured bank, even if the bank fails you will not lose money as long as your balance is under $250,000.

You can double your protection if you have a joint account or maintain different types of accounts. Check with your bank to make sure you are fully covered if in total you have more than $250,000 at one bank.

If you are single and maintain a balance of more than $250,000 you are at risk of losing the amount above that level should your bank go under.

Recent government intervention

With the SVB failure, the government declared that all depositors would be protected after they could not find a willing buyer for the bank. Essentially what they did is provide a large line of credit to banks that were upside-down on their bond investments. Instead of being forced to sell at a loss, these banks can use the value of their bonds to borrow enough to remain solvent. One concern people have is that banks are being allowed to value their bonds at par instead of at the actual price – meaning reduced values due to recent interest rate increases won’t limit their ability to borrow.

The question becomes how many banks will actually need to use this program. The government has guaranteed $25B in support of failing banks or those in danger of failing. This should increase confidence across the banking system, reducing or even eliminating people or businesses demanding deposits. Thus, banks will have more time to find other lending options or for them to sell their bonds in a better environment. Many people believe even if banks don’t use this program, the simple act of the government offering this backstop reduces the chance of other banks failing.

Downside of government involvement

Since SVB made the news, analysts have noted the missteps made by its leaders; in fact, on the Monday following the Friday takeover by the FDIC, SVB’s CEO and CFO were named in a lawsuit. Not only did the management team provide an inadequate response, over time they had allowed the bank to become too reliant on large money accounts. Another bank’s press release noted more than 80% of cash at this bank was guaranteed by the FDIC (meaning they have a diversified portfolio of smaller investors with some large investors) while the banks that had failed over the weekend had as little as 2% guaranteed (very little diversity, mostly large accounts). More recent reports note that 94% of SVB accounts were above the FDIC limit.

Government intervention also provides no reason for any of this to change. If you have $2M at a bank and the government will bail you out despite your laziness, why do anything different? Some are worried that the government is providing a precedent they may soon regret.

What you can do to keep your money safe

Most people won’t reach the $250,000 limit at their bank. However, even if you only have $2,000 in your checking account, make sure that your bank is FDIC-insured (or that your credit union has NCUA insurance). Should you be fortunate enough to have more than $250,000 in an account, understand how the account is named. If you have a joint account, you will have a larger limit than if you’re single. Similarly, if you have a brokerage account, you should be covered by a separate insurance program that will provide $500,000 in coverage for uninvested cash and securities.

What to do if your bank fails

If your bank fails (and you were covered by FDIC insurance), you may not notice a change immediately. The FDIC will inform you via letter that the bank has failed, but you should still be able to write checks, get money from the ATM, and make automatic payments as before.

Most banks are sold to other entities, so you will receive information welcoming you to the new bank and detailing what to do to receive new checks, ATM or debit cards, and online access. If the FDIC cannot find a buyer for your bank, they will send you a check for the insured balance amount. Their guidelines are to have checks to people within two days. This could provide a headache if you have bills due or automatic payments that were scheduled. Keep a close watch if you find out your bank is not being sold to a new bank.

Also keep an eye out for scams. With this being in the news, you may receive calls stating your bank has failed or is in trouble. Remember: you will receive a letter if your bank fails; the FDIC will not call you. If you receive a call, simply hang up. Should you be concerned, call your bank using the number from your statement or other trusted source to find out more.