Investments are tools that can help you achieve your dreams, save for your child’s college, or afford the trip of a lifetime. However, just like when you go into a hardware store looking for a particular bolt, you can be overwhelmed with the number and types of investments out there. Here’s a look at some of the most common investment classes.

The big three

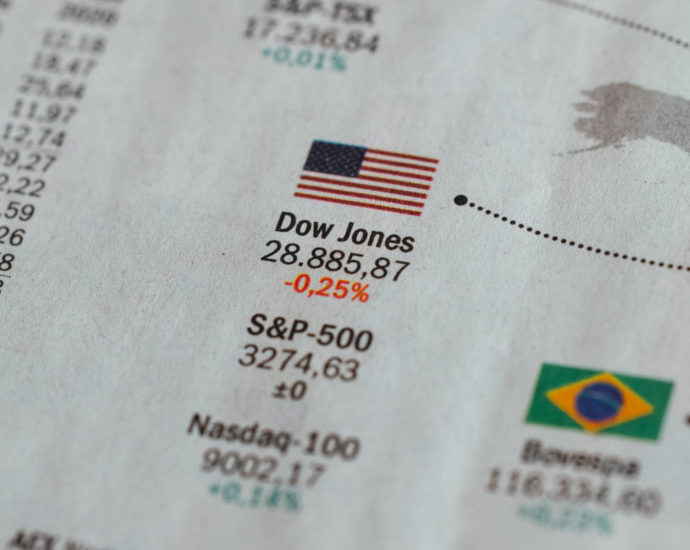

Stocks, bonds, and cash are the investments many people think of when someone mentions asset classes.

Buying a stock means you own part of a company. It’s really that simple. It’s probably just a tiny amount of the company, but you still own a portion. That means when the company does well your stock should do well, and vice versa.

Buying a bond means you’re lending money, usually to a government or business. You buy the bond (lending them money) and earn it back with interest over time.

Buying cash doesn’t mean going to the bank and withdrawing $200 from the ATM. Cash investments can be CDs or investing in a Money Market fund (more on mutual funds in a minute). Some even consider a savings account a cash investment. These investments are designed to keep your money safe rather than growing it for a future need.

Differing rates of return

In the world of finance, one rule usually holds true. The more risk you’re willing to take on, the more reward you should receive. Does this always work out? No. But over the long term, stocks are riskier, then bonds, then cash. Stocks usually return more, followed by bonds, and cash returns the lowest rate.

Quality of the underlying investment

While stocks usually outperform other investments, buying a stock in a poorly run company may return less than cash or even lose money. Bonds are rated from AAA (highest quality) to junk. Cash – well, it’s cash, but investing in the US dollar is more secure than investing in cash from an unstable country.

Mix them all together

You can buy any or all of these investments for your portfolio. For instance, if you want to invest in Target, you can buy as much Target stock as you can afford.

But maybe you want to invest in large companies, not just Target. Then you might choose a mutual fund of large-cap stocks. A mutual fund collects money from a pool or group of investors to buy and sell a mix of investments (stocks, bonds, cash, etc.). For instance, if you want to invest in large US corporations, there are many mutual funds that only buy and sell stocks of these companies. You simply choose the mutual fund you want, send some money, and you too own a slice of US large-cap stocks.

Mutual funds can consist of any mix of the three investment classes, from stock only to cash and stocks and bonds. And like before, stock-only mutual funds will be riskier (and should provide a better return) than funds that have a mix of the three classes.

There are as many mutual fund types as you can imagine, from small company stock funds to country-specific funds to a specific sectors (like utilities or healthcare) to funds that hold every company in the Fortune 500.

Mix them all together, part 2

Exchange-traded funds (ETF) are very similar to mutual funds. However, after the late 1990s, when many mutual funds received bad press over their practices (especially high undisclosed fees), ETFs really started to take off. There are two main differences between ETFs and mutual funds:

Fees – ETFs often will have lower fees than mutual funds. This isn’t a hard and fast rule. But if you’re looking at an index mutual fund, also look at a similar index ETF and compare fees and returns.

Trading – Mutual funds settle at 4pm. That means, you get one change in price per day. ETFs trade throughout the day, so like a stock their value can rise and fall much more often.

ETFs can track an index, but also can be focused on industry sectors or countries.

Other investments

Real Estate. Just like you can buy a house to rent for extra income, you can invest in large real estate holdings (malls, skyscrapers) through Real Estate Investment Trusts. Similar to a mutual fund, people pool their money to invest in an asset – this time being real estate.

Gold and other metals. For centuries, people have bought gold and countries have based their currencies on a gold standard. Mints around the world sell coins in high percentages of both silver and gold.

Cryptocurrency. Cryptocurrency is a digital currency. There are no bills or coins, everything is done online. None are issued by any central government. While for the most part secure, there have been several very high-profile instances where large quantities were stolen. This is not a cash investment – the price of cryptocurrency can fluctuate wildly.

These investments can add value and diversification to a portfolio. However, you as the investor need to thoroughly research the organizations selling them and evaluate each investment to see if it may help you meet your specific goals.

Scratch the surface

This is just an introduction to the broad ideas of asset classes and types of investments. If you decide to invest, thousands of mutual funds, ETFs, company stocks, bonds and cash investments will compete for your attention. Each will promise great things while offering different levels of risk and reward. No matter if you plan to go it alone or turn everything over to a financial planner, take some time to learn about investing. Become familiar with the types of investments and your goals so you can confidently talk to your planner or read through your retirement materials and make the best decisions for you.

Photo by Markus Spiske