When financial planners talk about budgeting or living within your means, people often picture a spartan lifestyle. However, having more coming in than going out can actually open up opportunities for living better than the Joneses. You can make informed choices with your money instead of being limited to paying off a credit card or other debt. Here are some advantages of living within your means.

Security

When you live below your means, over time you can build up a cash surplus to help provide security if an emergency hits. At some point your car is going to need a new timing belt or your TV may die or your computer will catch a virus. Even when you have the money, paying to replace something that just broke is never fun. But it’s a lot less fun when you don’t know where the money will come from (or if you have to juggle credit cards to keep your car running).

Reduced stress

Ever been in that situation where you had a week before payday and you weren’t able to buy groceries? Have you wondered where the money to pay the electric bill will come from? By spending less than you’re taking home, you won’t spend nights tossing and turning because you can’t pay for utilities.

You control debt

Notice I didn’t say you’re not in debt. Most people who own homes have a mortgage. But by watching your spending, you can make the decision to have good debt (a mortgage) versus bad debt (a credit card).

Become an owner

A lot of articles on the internet talk about how rich people are different from the rest of us. One of the ways they are different is that they are owners. Whether a home, stocks, or small businesses, rich people own things. By living below your means, you’re freeing up cash to become an owner too. Maybe you don’t want a house, but investing intrigues you. Or perhaps you’ve always wanted to open a donut shop because your friends have said your donuts are better than any they’ve tried. Being able to save money to become an owner is a huge step towards financial independence.

Freedom

To me, this is the biggest advantage of watching your spending. Having money gives you choices. Don’t like your job? Having a savings account means you’re not tied to it until you’re out of debt. Want to go on vacation? Saving for the trip means you can go, have fun, and come home without getting those stomach-churning credit card bills in the mail. Even something as small as buying Christmas presents can be a joy instead of stressful when you’re living below your means.

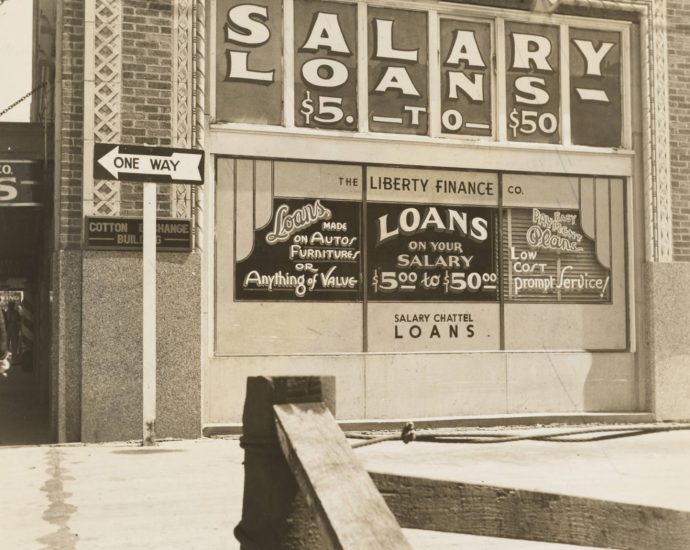

New York Public Library Image available through Unsplash.com