When you’re just starting out, credit may seem confusing. Most people have a basic understanding of a credit card. But you may not be aware of who looks at your credit information or why it’s important to maintain good credit.

Credit is pretty simple – it’s borrowing money to get something today that you will pay for later. Later can be the end of the month when your credit card bill comes due or the end of 30 years when your mortgage is paid off. Companies are willing to lend you money only if they have confidence you’ll pay it back.

If you are buying something at Target and put it on your credit card, you’re using credit. If you go into a wireless store to get a new phone plan and walk out with an $800 smart phone, they more than likely checked your credit. If you buy a car or house, they will definitely check your credit.

Secured…unsecured?

Secured credit is a loan that’s backed by something tangible. For instance, a home loan is backed by your house, a car loan your car. This collateral can be seized by the loan holder if you don’t pay on time, and they can resell it to make up for any loss on the loan.

Unsecured credit is based on your reputation and the prediction that you will pay back the loan. Credit cards, student loans, and medical bills are all types of unsecured credit. Your first credit card is probably one of the first loans you’ll get. Approval for this initial card is based on your income (unless someone co-signs the loan with you). Usually the card limit starts low and grows as you build a reputation for paying it off. Given credit cards are riskier for the lender (since they are unsecured), the interest rate for late payments tends to be very high. After you have established credit, a credit card company will look at a combination of your income and your credit-worthiness, and will often provide a larger credit limit if both are positive.

Do I really need credit?

I’m sure a few people have managed to make major purchases with cash. But in this day and age, life is more difficult (and possibly more expensive) if you don’t have credit.

For instance, if you are signing up for car insurance in many states, they will check your credit before quoting a price. Why? Well, some companies have research that links a higher credit score to more diligent driving behavior and fewer claims. Insurance can cost you more if you don’t have a good credit rating.

And it can affect where you live and work. Some landlords may check credit, and employers often use credit checks to help build a picture of the prospective employee. It has grown to mean more than just I can pay off my credit card.

Good vs bad

As you can see, good credit can pave the way for short- or long-term loans, but also give you a leg up on an apartment or job. Bad credit can make the hiring manager look at the next candidate. Credit bureaus – companies that make lots of money aggregating your loan data – use a simple three-digit credit score to rate you from an excellent to an awful credit risk.

Credit score

Your credit score is a compilation of your financial history: all the credit you’ve had, including loans and credit cards, how much you borrowed, how much you paid off every month, if you made all your payments, if you’ve had any loan go to bankruptcy, etc.

The score ranges from 350 to 850, with around 700 or above being good and 800 or above being excellent. Most people have scores that range from 600-750. According to Equifax, one-third of borrowers are considered subprime and would be required to pay a fee/deposit to secure a loan (or would be denied). 46% are in the top categories where they may receive better than average rates from lenders.

What that means in real terms is the credit score not only determines whether you will get the loan, but at what rate you will pay it back. An excellent credit score will result in your paying a lower interest rate over the life of the loan than a poor credit score.

Scores with an “S”

There are three main credit bureaus that compile your financial data – Equifax, Experian, and TransUnion. Each looks at your history a little differently, so your scores may differ depending on the company. Additionally you can have a FICO score or a VantageScore. There are even scores for different purchases; for instance, there’s a specialized score for buying a car or getting a credit card. With all these moving parts, just know that if you have good credit with one credit bureau you should have a similarly good credit with another, and if you have a high FICO score you should have a similar VantageScore.

Build good credit

Stay on top of your credit. Order a credit report and read through it line by line. Learn more about how credit scores are compiled. And use credit wisely – it can save you money (or cost you tons) depending on how you treat it.

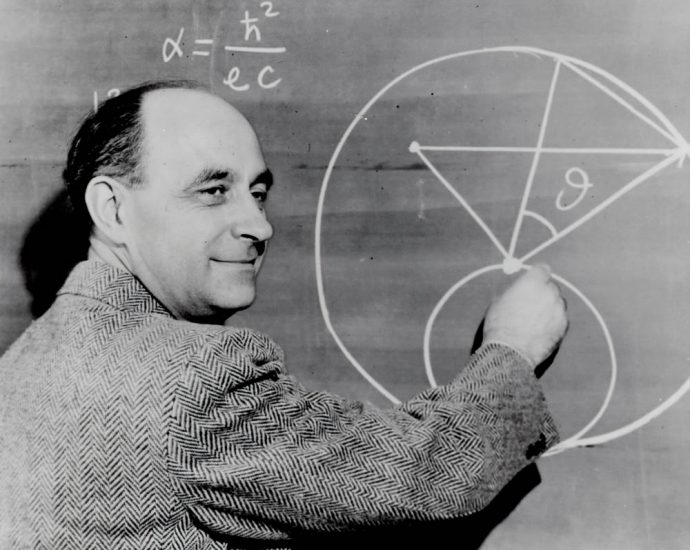

Photo by Science in HD