I recently suggested to both my kids that they set up an account with Social Security. They looked at me as if I had lost my mind. Yet there are some valid reasons that young people would benefit from logging in today.

Secure your account

It’s telling that this – secure your account – is first on my list. Yet given the number of incidents where personal information has been stolen, it makes sense to claim your Social Security account. While young people may not have a lot of job history, they can make sure that they – and only they – will be able to access their account in the future.

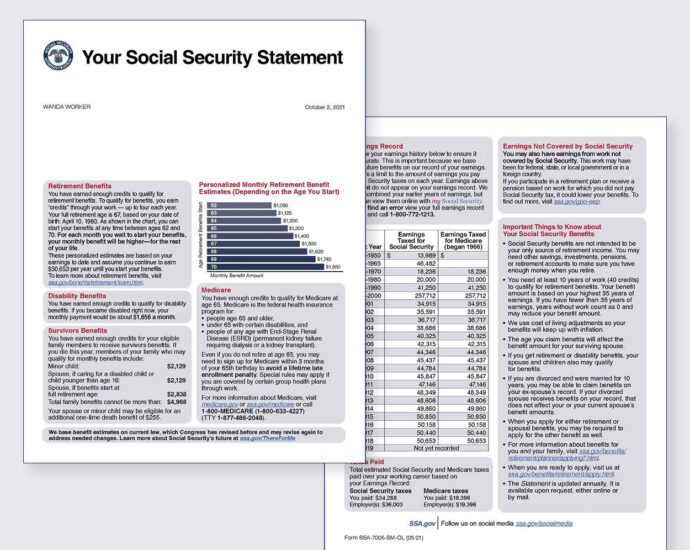

Discover how much you might receive at retirement

When you log in, you can check your statement to see how much you may receive at retirement, and how that amount would change if you retired at age 62, full retirement age (67), or age 70. The further away from retirement you are, the more this can change given you may have years of paychecks to come before you retire. But it will be a valuable number as you enter middle age because it can help you determine if you are on target for the retirement you want.

Verify your earnings history

When I started working, there was no easy way to verify that the Social Security Administration had correctly input my salary for the year. Today, all you have to do is log in. While I wouldn’t suggest logging in every year, it doesn’t hurt to do this every few years. You want to make sure that you will receive every dollar you are entitled to when you retire. Plus, the Social Security Administration limits your ability to change your earnings record. Normally you cannot contest your earnings after “3 years, 3 months, and 15 days from the end of the taxable year”. Yes, that’s the number they came up with. However, there are some specific incidences where you have a longer period of time to correct errors. You can click the link for more information.

Learn more about family benefits

You may receive benefits based on your spouse’s benefit if it’s higher than benefits based on your work record. Family members may receive survivor benefits if they are dependent on your income. You can also find out about disability benefits, including whether or not you have earned enough credits to qualify for disability.

Manage your account when you begin receiving benefits

If you move or change banks, you can update this information on the Social Security website. Similarly, if you lose your card or benefit verification letter, you can request a new one at their site.

Discover a different break-even point

Many people talk about the break-even point when they are deciding to take benefits. Will they receive more money by claiming benefits at age 62 or waiting until age 70. There are calculators online that can help you make this decision.

I like to look at the amount that I’ve paid in Social Security taxes to see how long I have to take benefits to recoup my money. Yeah, it’s a random data point, because it’s not like I can force myself to live until I’m making money off the federal government. But it’s still an interesting fact to know as I near retirement.

Even if you’re nowhere near retiring, it’s beneficial to set up an online account with the Social Security Administration. You can secure your account, double-check their record keeping, and even see an estimate of how much you will receive once you retire.