It’s never good when the IRS states that this year could be “challenging” at the same time they announce that they are accepting returns. Yet due to COVID and staffing issues, the IRS is behind in processing LAST year’s returns: as many as nine million returns have not been dealt with. All the more reason that you may want to start now so you aren’t at the back of the line, especially if you’re expecting a refund from 2021.

Gather your documents

You may think “no kidding” when someone says to get your documents together, but you will save a ton of time if you gather everything before you sit down at your computer (or go through the paper forms) to enter information. If you’re like me, your mailbox and email account started filling up in late-January with announcements of when statements would be available or with the actual documents.

If this is your first time filing a return, you’re going to be at a disadvantage in that you won’t have an idea of when everything you need has been received. However, know that you should expect statements showing income (1099 or W2), statements showing interest or dividend payments (if you have a taxable brokerage or other investment account), and confirmation from the IRS with any Child Tax Credit or stimulus payments for the year. In addition, you will need to gather receipts to support deductions and also watch for a state tax return 1099 for the prior year.

Don’t throw away letters appearing in the mail

In the list of items above, you may have noticed that the IRS has sent letters containing information on the Child Tax Credit and stimulus payments.

Make sure Child Tax Credits are correct. If you received the Child Tax Credit during the second half of 2021, don’t throw the IRS’ letter away. The money you received was in fact an advance payment that you would have received after filing this year’s tax return. You will need to enter that information to reconcile the payment with what you should have received.

Just a word of caution – the IRS has already noted that some letters went out containing errors. Look back at your payments, total them up, and make sure the total matches what’s on the IRS letter. If there are discrepancies, contact the IRS.

Claim any missing stimulus payment. If you didn’t qualify for the third stimulus or only received a portion of what you were entitled to, you can claim the remainder through this year’s tax return. The IRS will send a letter detailing the amount you received (if any). You can contact the IRS or visit their website for more information about claiming missing stimulus money.

Double check everything, then check it again

I wouldn’t suggest this as a way of handling your taxes, but it’s what works for me. I do an initial run through just to see what’s going on and to note any missing information so I can find it. No matter how many years I do this, I still discover that I didn’t download a statement or am missing a deduction receipt that I know I should have. Once I have entered all the information, I stop and let it sit. I call this sleeping on it. Depending on how early I’ve finished the initial draft, I pause for several days or even a week. Then I go back through it, looking closely for anything I might have missed. Finally, I proof my draft against the original documents once more to make sure I didn’t transpose a number.

Most people won’t want to go through this process; I understand that. But at the very least, go through your original documents (W2s, 1099s, etc) twice to make sure your entries are correct. Also check your Social Security number, filing status, and name and address. Small errors often cause delays in your refund. The IRS has a handy checklist of these and other areas to double check.

Electronic filing with direct deposit results in faster refunds

Many small errors can be minimized by using software. I’m not going to recommend a brand, but I have used one of the big two for years and have been happy with the results. One benefit is the software pulls last year’s information, so while I have to verify my kids’ Social Security numbers I don’t have to retype them. And I don’t have to worry about calculation errors; as long as what I enter matches the forms I received, it’s relatively bullet-proof.

The IRS recommends choosing direct deposit to speed up the process even more. Whether or not you are in that much of a rush for your refund depends on you. I have never provided them with my banking information due to security concerns; I try to limit the number of outside companies that have my bank account info. Even if you choose electronic filing with direct deposit, your refund may take three weeks to process.

Deadline: April 18

Due to a holiday, you have three extra days this year to file your return. With the “challenges” the IRS has already mentioned, you should try to file your return as soon as you’ve received all your paperwork. Plus the earlier you send in your return, the less likely someone will try to scam the system by submitting a bogus return in your name.

I have always completed my tax returns, first by using paper forms and more recently with the help of software. If you choose to hire a professional, many of these steps are still important. Make sure you’ve received all your information before you have them take a crack at your return. Double check your Child Tax Credit or stimulus payment so they have the correct information. And when you have a chance to review their work, go through it using the original documents to ensure they entered all information correctly.

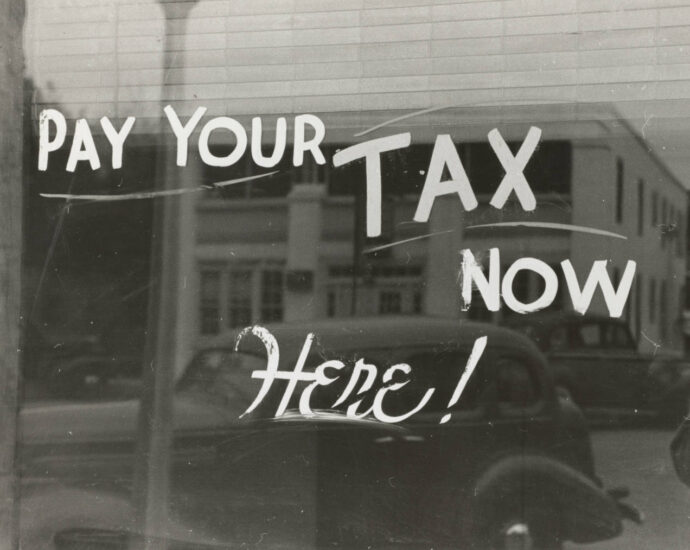

Photo thanks to NY Public Library